Medium-Term Business Plan

MIDDLE PLAN

OYO Group Medium-Term Business Plan "OYO Advance 2023"

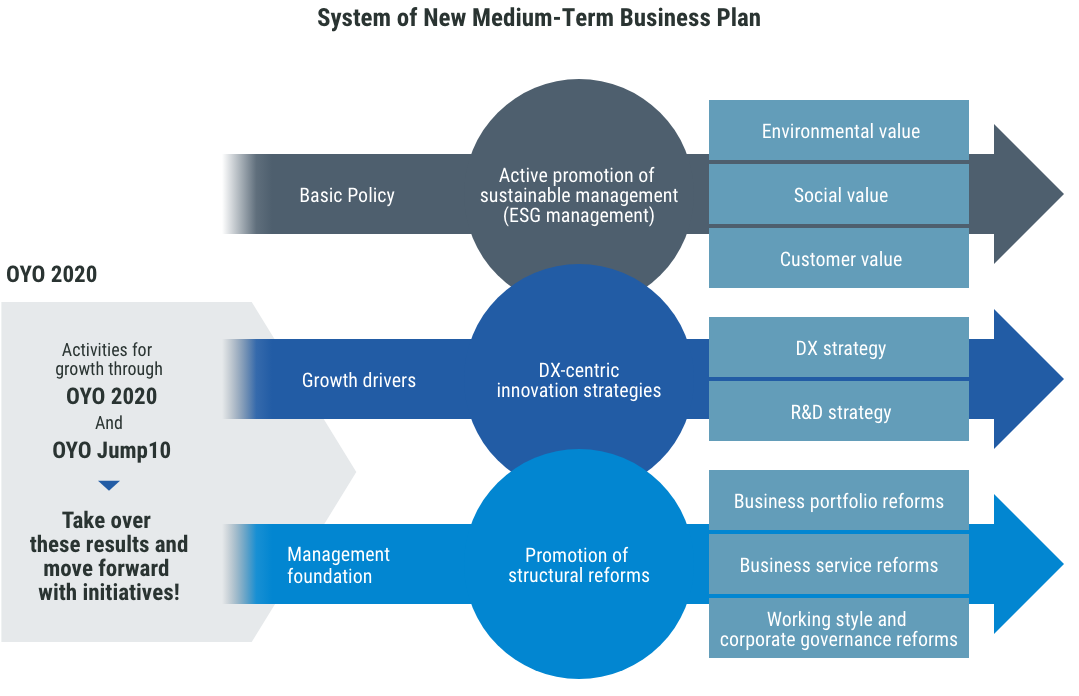

The OYO Group is currently promoting ESG management based on the Medium-Term Business Plan "OYO Advance 2023", which ends in the fiscal year ending December 31, 2023, and is taking on the challenge of a new value creation process that contributes to the achievement of the SDGs.

Looking back on the Long-Term Management Vision "OYO 2020" and the previous Medium-Term Business Plan "OYO Jump 18"

In the previous Medium-Term Business Plan "OYO Jump18", which we promoted under our Long-Term Management Vision "OYO 2020", we have achieved many successes that will lead to the future

- OYO Hop 10Search for the next business to convert from a business based on successful experience

- OYO Step 14Replace the shrinking business based on successful experience with the transformed business

- OYO Jump 18Expand business through a transformed business style

In the Long-Term Management Vision "OYO2020" and the previous Medium-Term Business Plan "OYO Jump 18", the OYO Group has promoted organizational structure reforms and management system reforms; for example, shifting from the conventional business style of a "branch office system" that depends on public works to "Division System" which focuses on "creating sellable products" based on market and social issues.

We have also focused on DX (Digital Transformation) initiatives, which seek to incorporate digital technology into all aspects of our management, thereby deepening existing businesses and creating new business models.

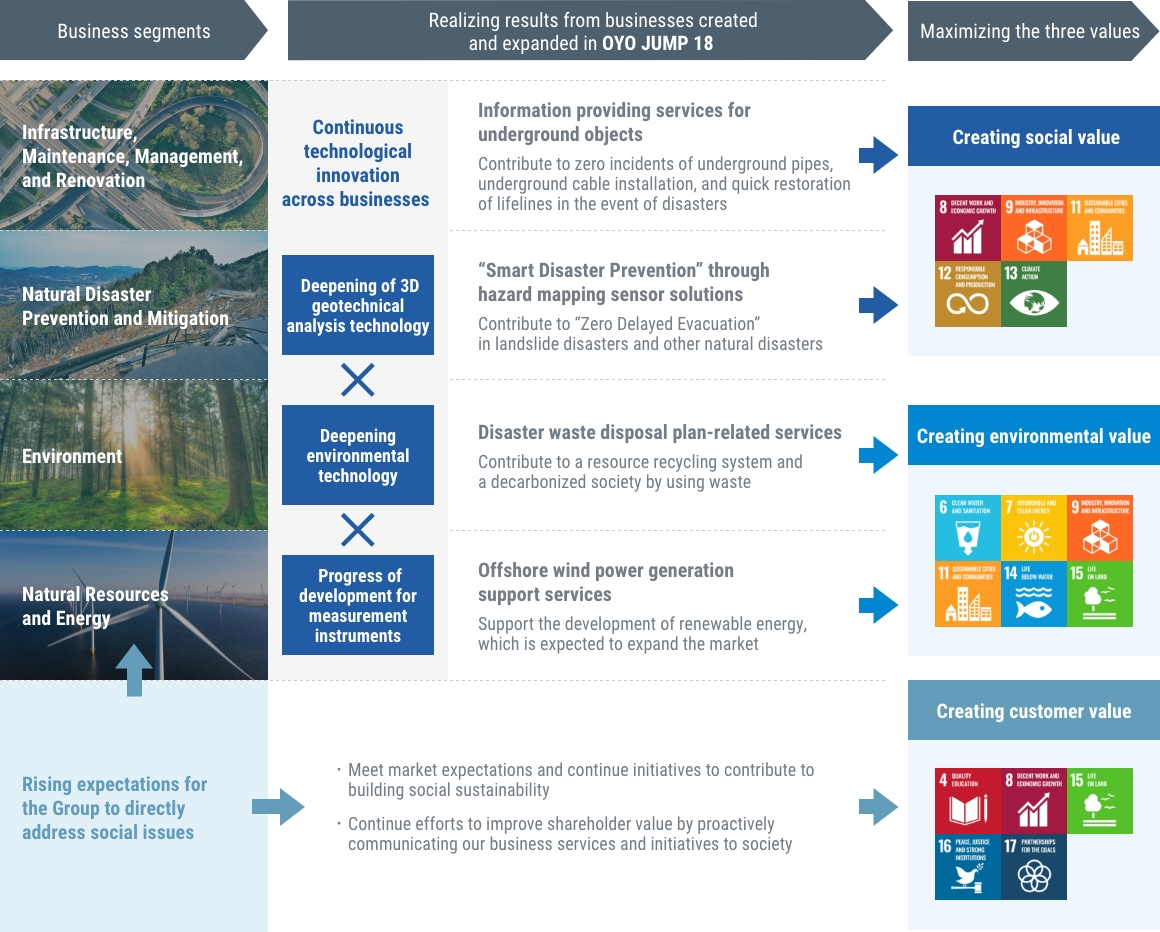

As a result, we succeeded in creating and expanding new businesses such as disaster waste disposal support services and offshore wind power generation business support services. We also worked on the development of new technologies and businesses that are expected to grow in the future, such as a service which utilizes 3D geotechnical analysis technology to provide information on objects buried underground and an intelligent disaster prevention system that utilizes a large number of sensors.

The two businesses cultivating new markets have both achieved the No. 1 market share

Disaster waste disposal-related services

Share in formulation of disaster waste disposal plans

No.1

Development and provision of systems to support disaster waste disposal plans.

We estimate the amount of disaster waste generated, calculate the optimal transportation plan, and contribute to the construction of a crisis management system aiming for the

shortest possible recovery.

Offshore wind power generation support services

Share in surveys for selecting suitable locations

No.1

Possession of a variety of equipment for suitable location selection surveys of seabed-fixed or floating offshore wind power generation.

We support the expansion of offshore wind power generation through the integration of the Group’s technologies.

Use of DX to steadily promote the conversion of new technology into services

Underground visualization services

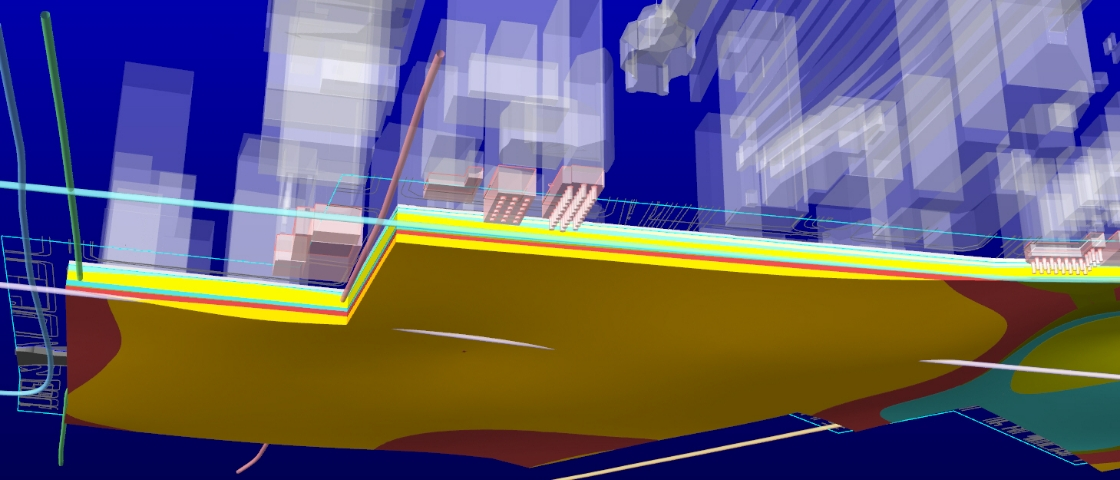

A business co-created with Hitachi, Ltd. We visualize in 3D the position information for objects buried underground beneath roads and then provide that information on-demand via the cloud.

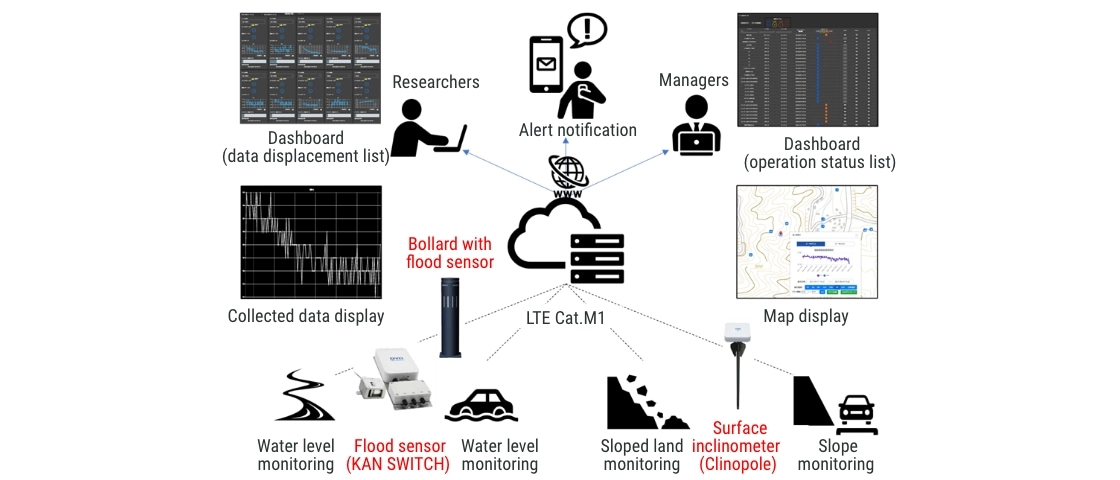

Hazard mapping sensor solutions

Our "Smart Disaster Prevention" system uses a large number of installed sensors to monitor a wide-range of target areas in real time. We started services in 2020 with the aim of "Zero Delayed Evacuation" from natural disasters.

Position of OYO Advance 2023

An important three-year period for linking the results of activities aimed at the growth of OYO Jump 18 to business earnings Promote innovation and structural reforms to create a foundation leading to the next long-term management vision Take on the full-scale challenge of a new value creation process for sustainable management

- OYO Hop 10Search for the next business to convert from a business based on successful experience

- OYO Step 14Replace the shrinking business based on successful experience with the transformed business

- OYO Jump 18Expand business through a transformed business style

In OYO Advance 2023, we will steadily grow the new markets and emerging technologies that have been created and cultivated in OYO Jump 18 as the next profitable business of the OYO Group. We are also taking on the challenge of new value creation processes that contribute to the achievement of ESG management and SDGs.

Overview of OYO Advance 2023

The OYO Advance 2023 will take the following measures to grow into a profitable business while continuing the results of activities under the previous long-term business vision "OYO 2020" and the previous medium-term business plan "OYO Jump 18."

(1) Basic Policy

Sustainable management

Based on the basic policy of Sustainable Management (ESG management and achieving SDGs), we will maximize the three values of "social value", "environmental value", and "customer value" through our core business (four business segments).

(2) Growth drivers

Aggressive investment in DX-centric innovation strategies

Innovation strategies

DX strategies

Strategy Promotion Policy

- From digitization to digitalization, we will continue to aggressively invest in digital technology and to promote business transformation, productivity improvement, and work style reform.

3-year investment amount (2021-2023)

1.0 billion yen

Specific measures

- Promote DX to create new business services

- Promote DX to deepen existing business models

- Promote DX for work style reform and innovative enhancement of productivity

R&D Strategy

Strategy Promotion Policy

- Establish competitive digital solutions by accelerating technology fusion and combining digital technologies within the Group

- Concentrate investment in strategic fields in each segment

- Acquire external technologies necessary for competitive advantages through aggressive promotion of alliances and M&A

3-year investment amount (2021-2023)

4.5 billion yen

Specific measures

- BIM/CIM: Continue promotion of 3D geological analysis technology

- Measurement and exploration equipment: Development of new products, improvement of existing products

We will promote the growth of the entire Group by actively investing in innovation strategies centered on DX. Specifically, we will set 1.0 billion yen for DX strategic investment and 4.5 billion yen for R&D strategy, totaling 5.5 billion yen in investments for the next three years.

(3) Management foundation

Structural Reform Policy

Aiming to accelerate decarbonization, we will establish the next growth foundation by promoting DX-centric innovation and implementing structural reforms without any exceptions

Business portfolio reform

4 Business segment reform

- Expand the portfolios of the Infrastructure and Maintenance; Natural Disaster Prevention and Mitigation; and Environment segments

- In the Natural Resources and Energy segment, accelerate the shift to a decarbonized market

Reform of domestic and overseas Group companies

- Promote reorganization and integration of domestic and overseas Group companies through M&A by business segment

- For overseas Group companies, consider selection and concentration based mainly on the potential for decarbonization and profitability

Business service reforms

Reform through fusion of technologies

- Promote fusion of technologies across the OYO Group through collaboration between segments to create one-stop solution services

Reform through co-creation

- Reform business services through DX, innovation and cross-industrial co-creation

Work-style and corporate governance reforms

Utilize DX to realize diverse work styles

- Actively promote DX to realize diverse work styles

Corporate governance reforms to enhance corporate value over the medium- to long-term

- Promote corporate governance reforms, making it an important theme of management to achieve continuous growth and enhance corporate value over the medium- to long-term

As the global trend of decarbonization accelerates, we will establish a future growth foundation for the Group through innovation centered on DX and the three structural reforms listed above.

(4) Targeted Business Indices

| Results for FY2020 | Targets for FY2023 | Growth rate | ||

|---|---|---|---|---|

| Targeted Business Indices | Net sales | 49.6 billion yen | 62 billion yen | 125% |

| Operating income margin | 5.1% | 8.0% | +2.9 point | |

| ROE | 2.6% | 5.0% | +2.4 point | |

| Net Sales by Segment | Infrastructure and Maintenance | 18.7 billion yen | 24 billion yen | 128% |

| Natural Disaster Prevention and Mitigation | 13.2 billion yen | 16 billion yen | 121% | |

| Environment | 9.3 billion yen | 11.5 billion yen | 124% | |

| Natural Resources and Energy | 8.3 billion yen | 10.5 billion yen | 127% | |

| Net Sales Ratio Domestic vs. Overseas | 82:18 | 75:25 | ||

The targeted business indices for the fiscal year ending December 31, 2023, which is final year of OYO Advance 2023, are consolidated net sales of 62 billion yen, an operating income margin of 8%, and a return on equity (ROE) of 5%.

(5) Investment strategy and dividend policy

Investment strategy

Innovation investment

DX investment

1.0billion yen

R&D investment

4.5billion yen

5.5billion yen

Create new businesses and expand in-house DX investment for digitalization Promote de facto standardization of 3D geological analysis technology for BIM/CIM

M&A investment

Actively invest in high-quality projects that are expected to generate business restructuring/integration effects and synergies, both domestically and internationally

M&A investment quota

7.0billion yen

- *The effects of M&A are not included in targeted business indices

Shareholder returns

Dividends policy

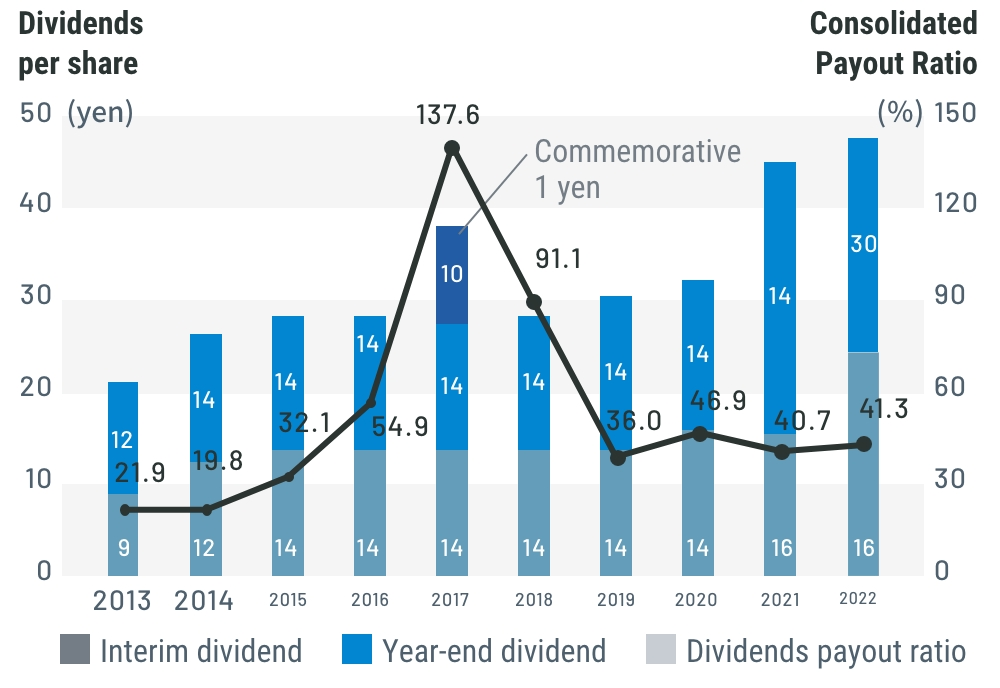

Consolidated Payout Ratio

30~50%

As a stable dividends target

Dividend record

Dividends Per Share and Consolidated Payout Ratio

Basic Policy on Share Buybacks

Consider flexible acquisition and cancellation of treasury stock based on treasury stock holding status, financial situation, market environment, etc.

We have set an M&A investment quota of 12 billion yen and are investing in high-quality projects in Japan and overseas.

- *The effects of M&A are not included above in (4) Targeted Business Indices.

- *In November 2021, we changed the M&A investment quota from the initial amount of 7 billion yen to 12 billion yen

- *In November 2021, we changed the dividend policy by raising the consolidated dividend payout ratio from "30% to 50%" to "40% to 60%"