Medium-Term Business Plan

Medium Term Business Plan

In February 2024, the OYO Group established "OYO Sustainability Vision 2030" and "OYO Medium-Term Business Plan 2026".

For more detailed information, please see the reference materials below.

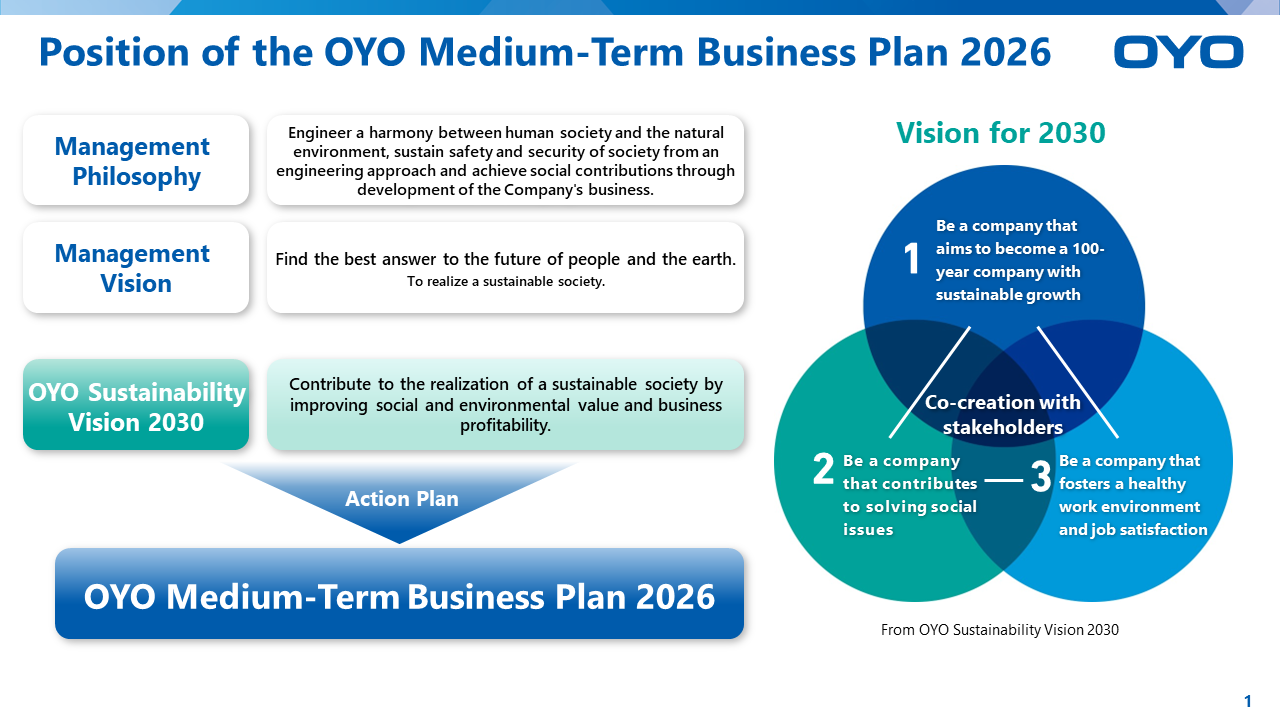

Position of the OYO Medium-Term Business Plan 2026

The OYO Medium-Term Business Plan 2026 was created as an action plan to achieve the OYO Sustainability Vision 2030. It outlines the specific actions that the OYO Group needs to take in order to ensure a better future for people and the planet by 2030 - the final year of the SDGs.

The OYO Sustainability Vision 2030 sets a new vision of what we want to be in 2030 to embody our management philosophy and vision. We aim to achieve this vision through the OYO Medium-Term Business Plan 2026 by enhancing social and environmental value while also increasing business profitability to contribute to the realization of a sustainable society.

- Vision for 2030

-

- Be a company that aims to become a 100-year company with sustainable growth

- Be a company that contributes to solving social issues

- Be a company that fosters a healthy work environment and job satisfaction

Targets

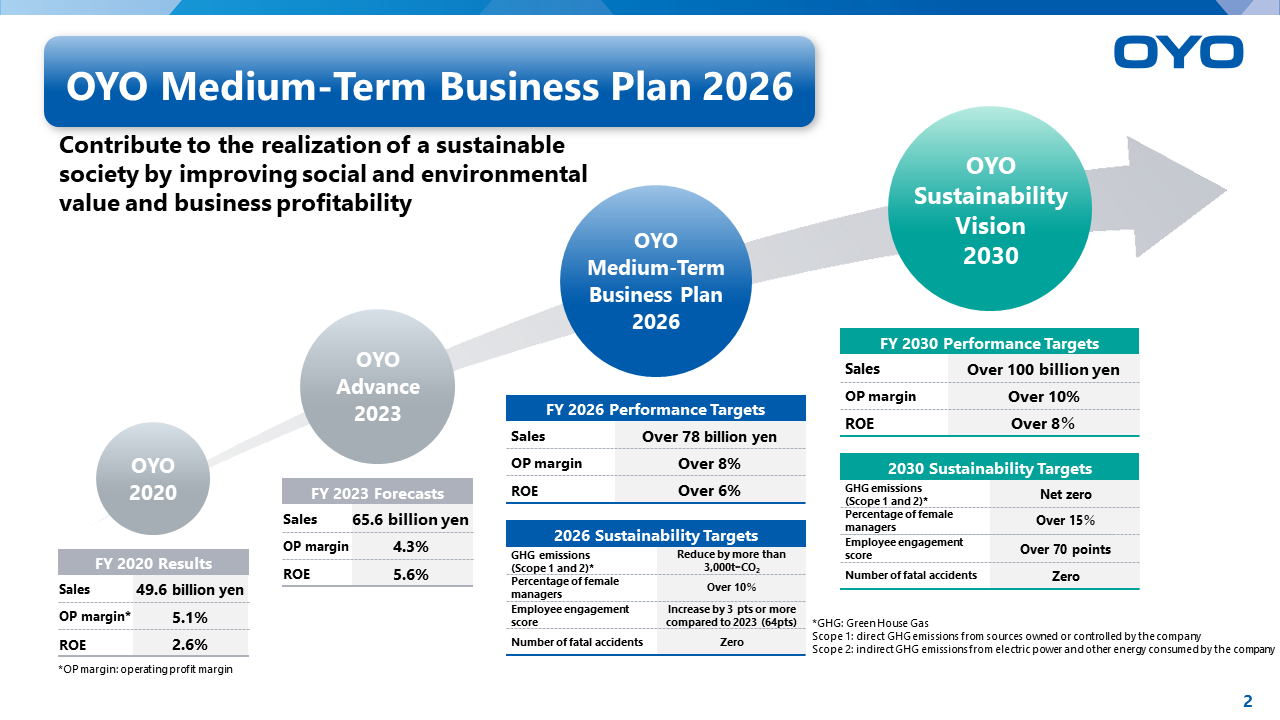

OYO Medium-Term Business Plan 2026

| FY 2026 Performance Targets | |

|---|---|

| Sales | Over 78 billion yen |

| Operating profit margin | Over 8% |

| ROE | Over 6% |

| 2026 Sustainability Targets | |

|---|---|

| GHG emissions (Scope 1 and 2)*1 | Reduce by more than 3,000t-CO2 |

| Percentage of female managers | Over 10% |

| Employee engagement score (non-consolidated) |

+3 points or more compared to 2023 (64 pts) |

| Number of fatal accidents | Zero |

OYO Sustainability Vision 2030

| FY 2030 Performance Targets | |

|---|---|

| Net sales | Over 100 billion yen |

| Operating profit margin | Over 10% |

| ROE | Over 8% |

| 2030 Sustainability Targets | |

|---|---|

| GHG emissions (Scope 1 and 2)*1 | Net zero |

| Percentage of female managers | Over 15% |

| Employee engagement score (non-consolidated) |

Over 70 points |

| Number of fatal accidents | Zero |

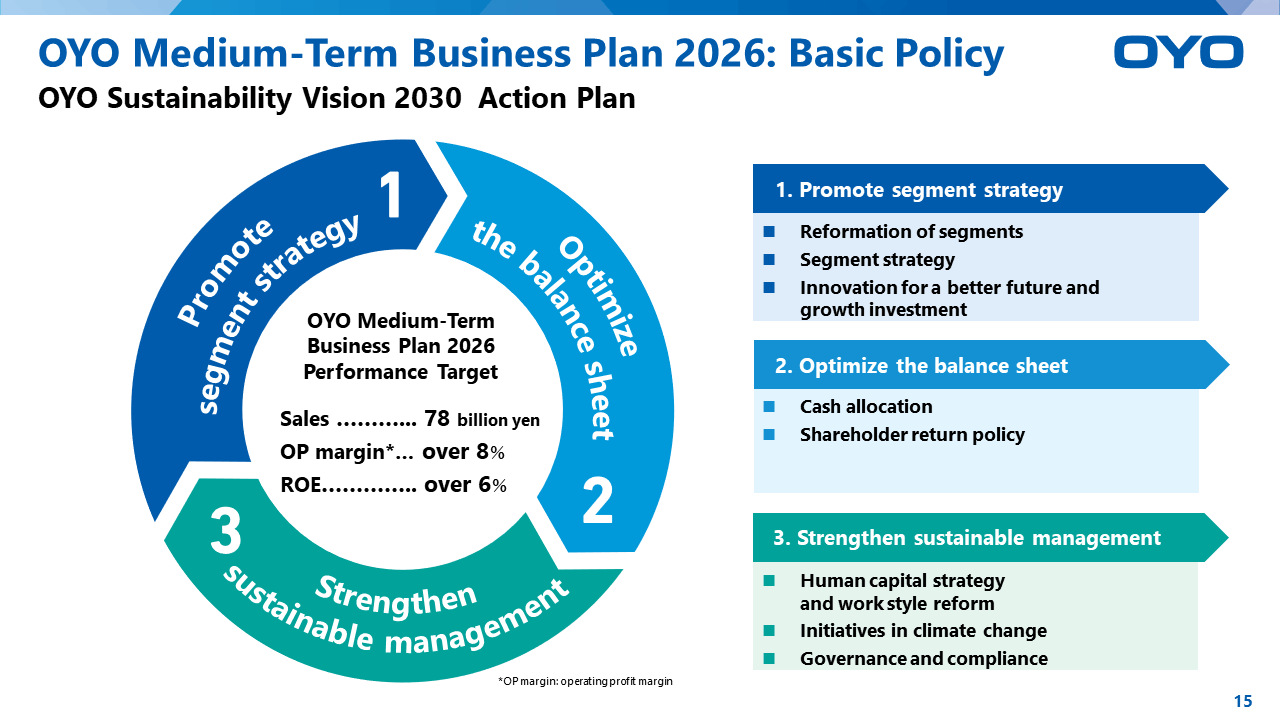

Basic Policy

The OYO Medium-Term Business Plan for 2026 is based on three policies: to promote segment strategy, to optimize the balance sheet, and to strengthen sustainable management.

By implementing the measures, we aim to achieve sales of 78 billion yen, an operating profit margin of 8% or more, and an ROE of 6% or more by 2026.

Promote Segment Strategy

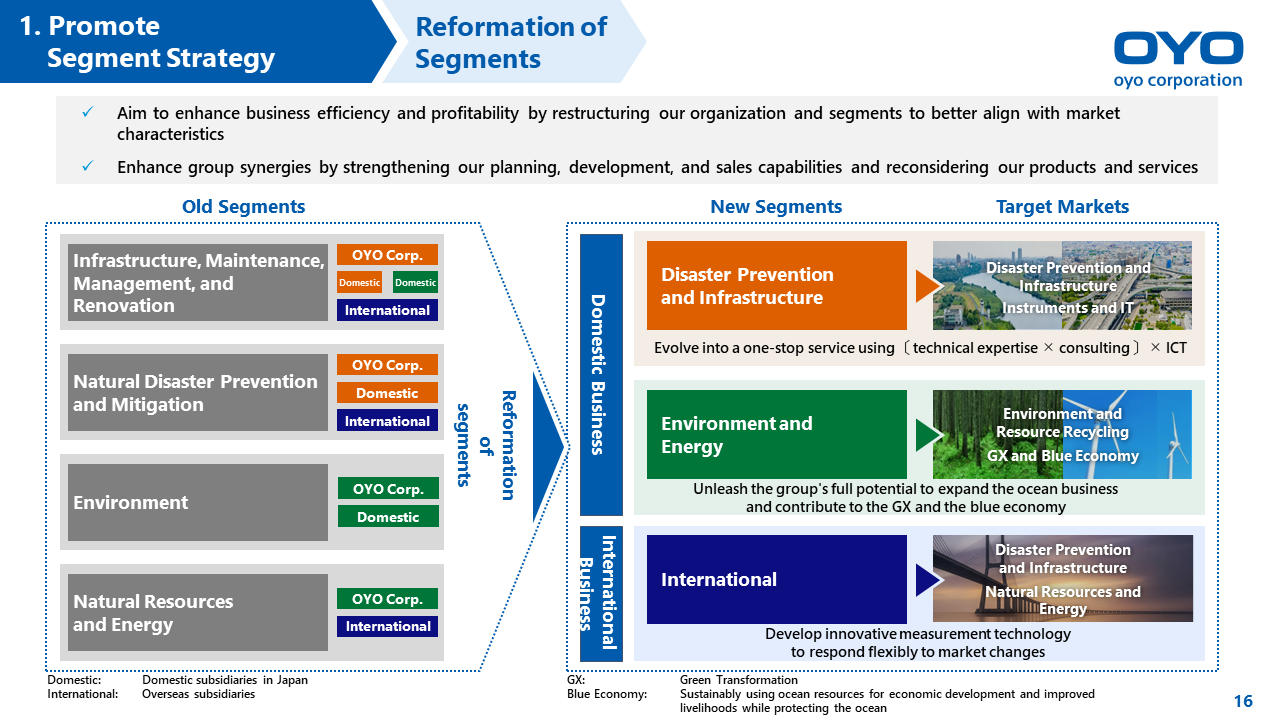

In order to improve business efficiency and profitability, we have reformed our organization and segments to match market needs.

We have separated our domestic and international businesses to streamline operations. Our domestic business is consisted of two segments - "Disaster Prevention and Infrastructure" and "Environment and Energy." Additionally, we created an "International" segment that comprises the businesses of our overseas subsidiaries. Our aim behind these changes is to maximize group synergy, reform our products and services, and strengthen our planning, development, and sales capabilities.

"Disaster Prevention and Infrastructure"

Evolve into a one-stop service using 〔 technical expertise × consulting 〕× ICT

| Target markets |

|

|---|

"Environment and Energy"

Unleash the group's full potential to expand the ocean business and contribute to the GX*2 and the blue economy*3

| Target markets |

|

|---|

"International"

Develop innovative measurement technology to respond flexibly to market changes

| Target markets |

|

|---|

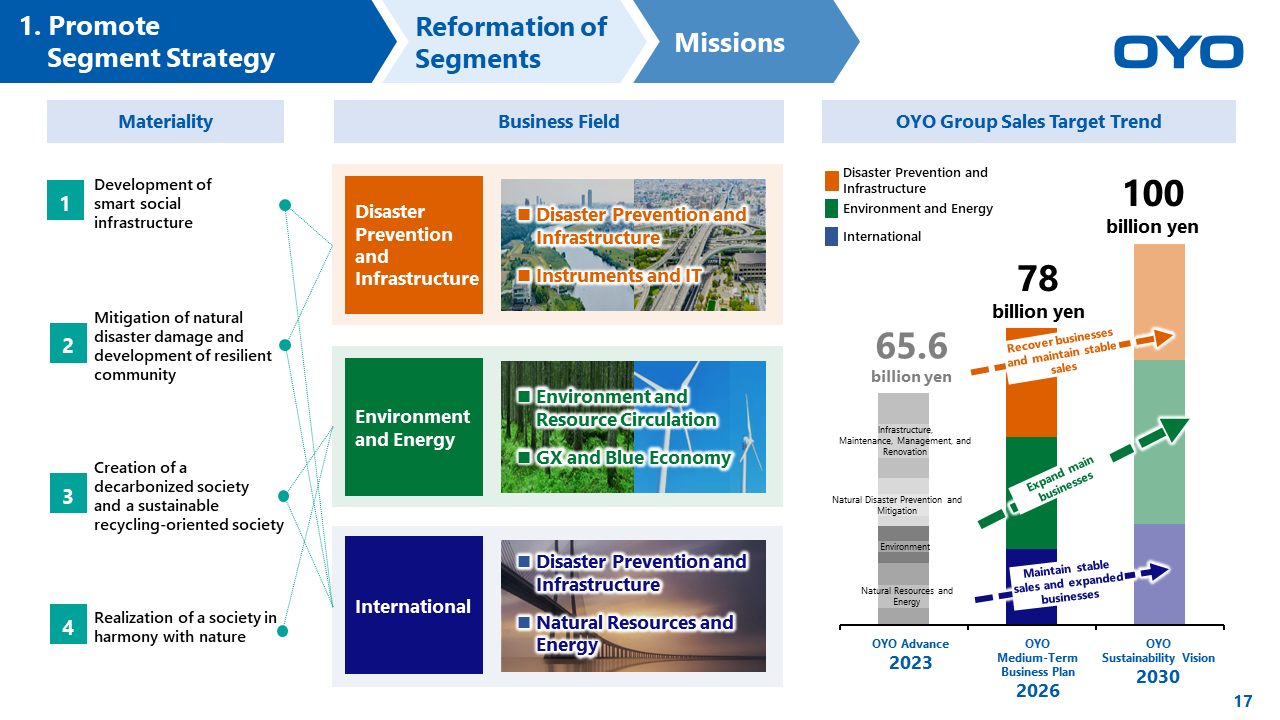

We aim to improve social and environmental value and business profitability by implementing growth strategies and addressing materiality in each segment that aligns with market trends, thereby contributing to the realization of a sustainable society.

| Materiality | Segment |

|---|---|

|

Development of smart social infrastructure |

|

|

Mitigation of natural disaster damage and development of resilient community |

|

|

Creation of a decarbonized society and a sustainable recycling-oriented society |

|

|

Realization of a society in harmony with nature |

|

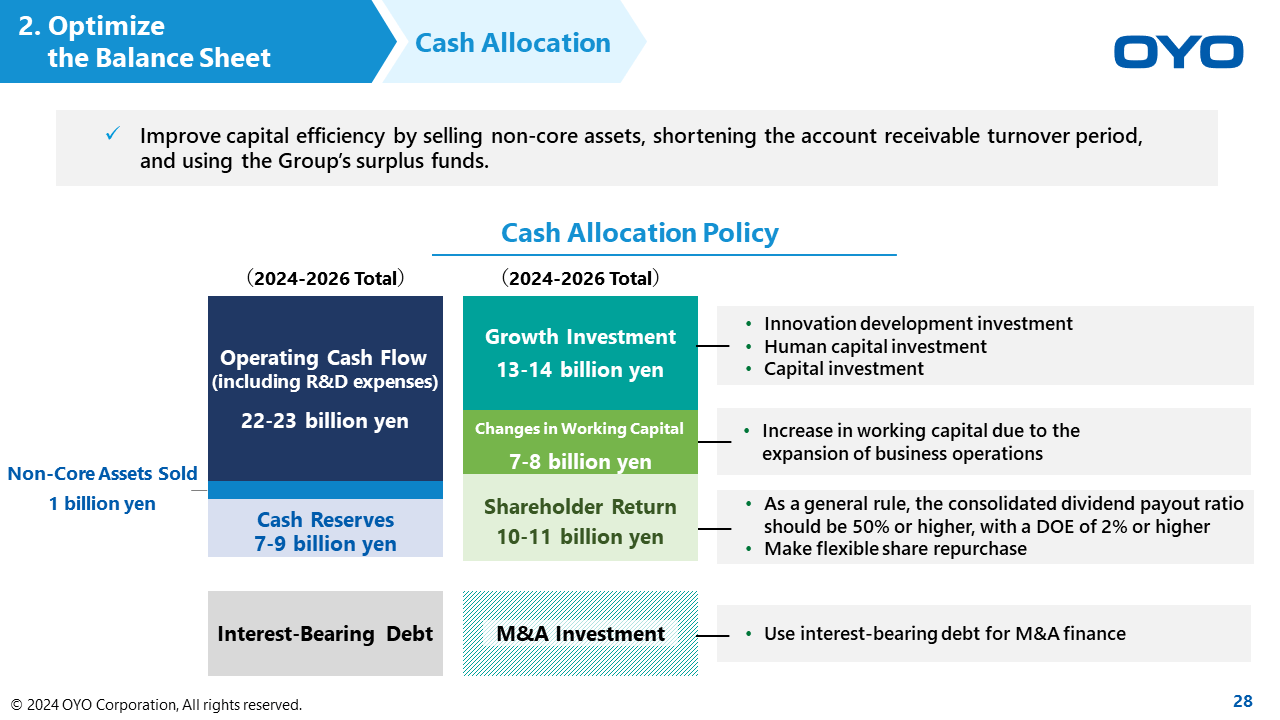

Optimize the Balance Sheet

Cash Allocation

We aim to improve capital efficiency by selling non-core assets, shortening the account receivable turnover period, and using the Group's surplus funds.

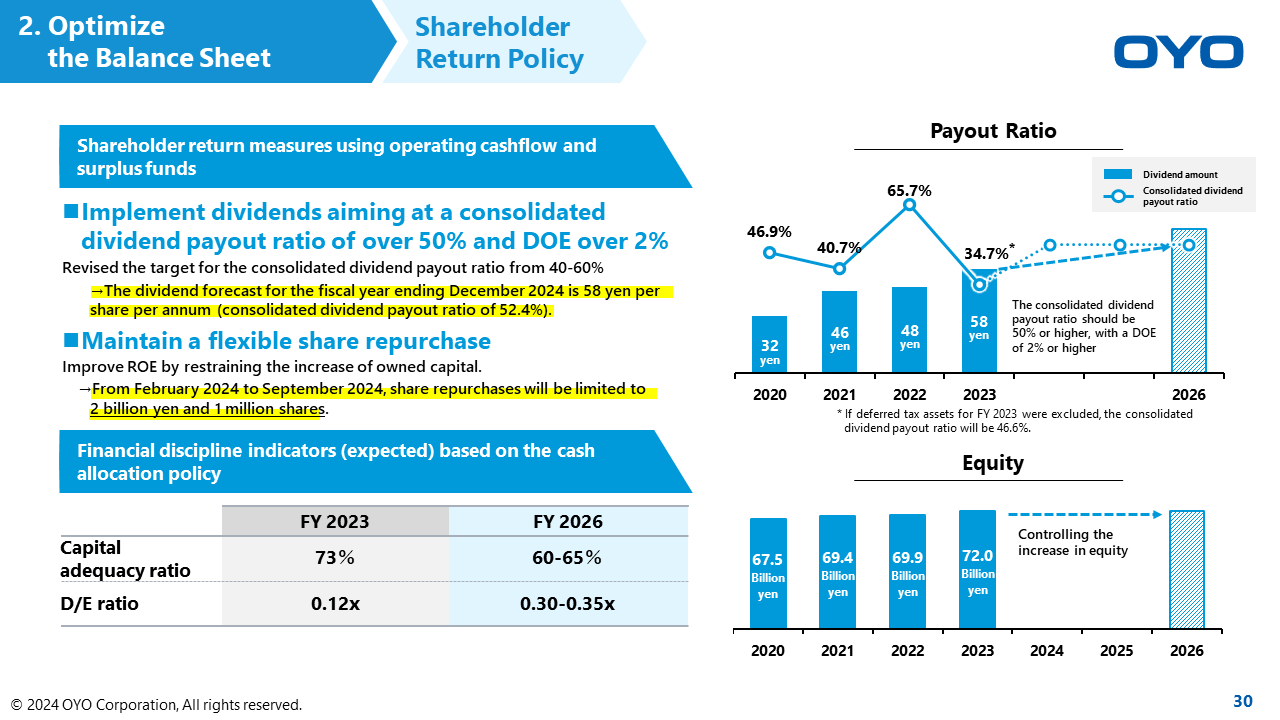

Shareholder Return Policy

We recognize that shareholder return is a critical management issue, and we plan to implement stable dividends for shareholders.

We have revised our previous medium-term business plan target for a consolidated dividend payout ratio of 40-60% to a consolidated dividend payout ratio of over 50% and a DOE of over 2%.

Furthermore, in order to improve ROE by limiting the increase in equity, we aim to maintain a flexible share repurchase limited to 2 billion yen and 1 million shares.

Strengthen Sustainable Management

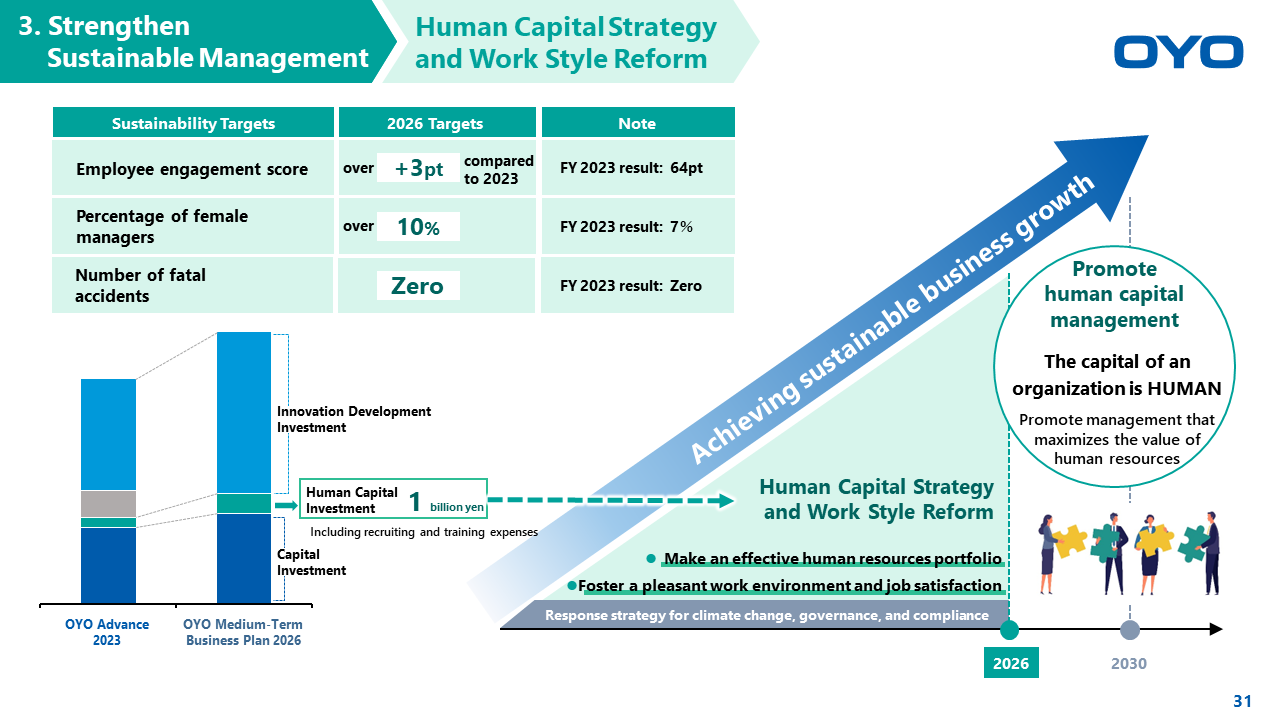

Human Capital Strategy and Work Style Reform

We recognize that our employees are our essential capital and that sustained company growth depends on ongoing investments in and enhancements to human capital. We are dedicated to supporting human capital management strategies that seek to maximize the value of human resources.

We will invest 1 billion yen in recruitment and training with the goal of creating an effective human resources portfolio and foster a pleasant work environment and job satisfaction.

| Sustainability Targets | FY 2023 Results | FY 2026 Targets |

|---|---|---|

| Employee engagement score (non-consolidated) | 64 points | Over +3 points compared to 2023 |

| Percentage of female managers | 7% | Over 10% |

| Number of fatal accidents | Zero | Zero |

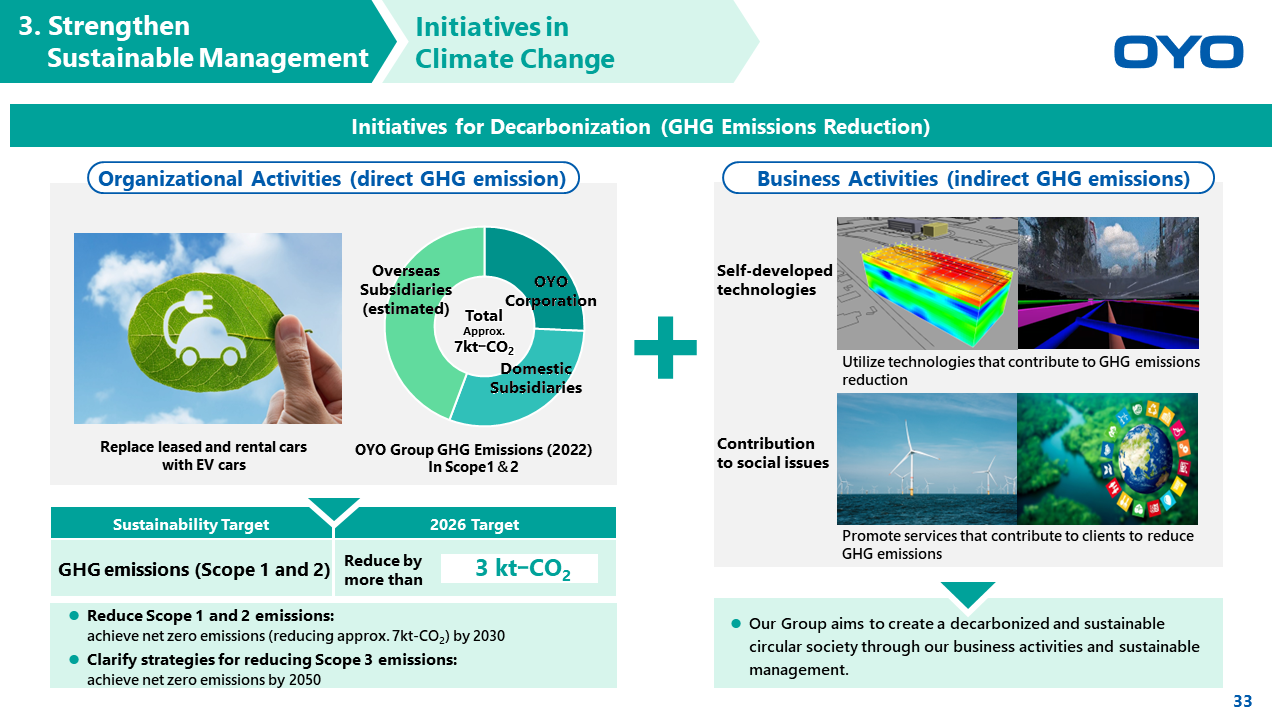

Initiatives in Climate Change

We aim to create a decarbonized and sustainable circular society through the decarbonization initiatives of organizational activities (direct GHG*1 emissions reduction) and business activities (indirect GHG*1 emissions reduction).

Organizational Activities (Direct GHG*1 Emissions Reduction)

We aim to reduce GHG*1 emissions by more than 3,000t-CO2 by the 2026 target by replacing leased vehicles and rental cars with EV vehicles, as well as promoting direct reductions in GHG*1 emissions across the entire OYO Group.

Business Activities (Indirect GHG*1 Emissions Reduction)

Through our business activities and sustainable management, we will contribute to the reduction of GHG*1 emissions by developing our technologies and conducting carbon-free businesses.

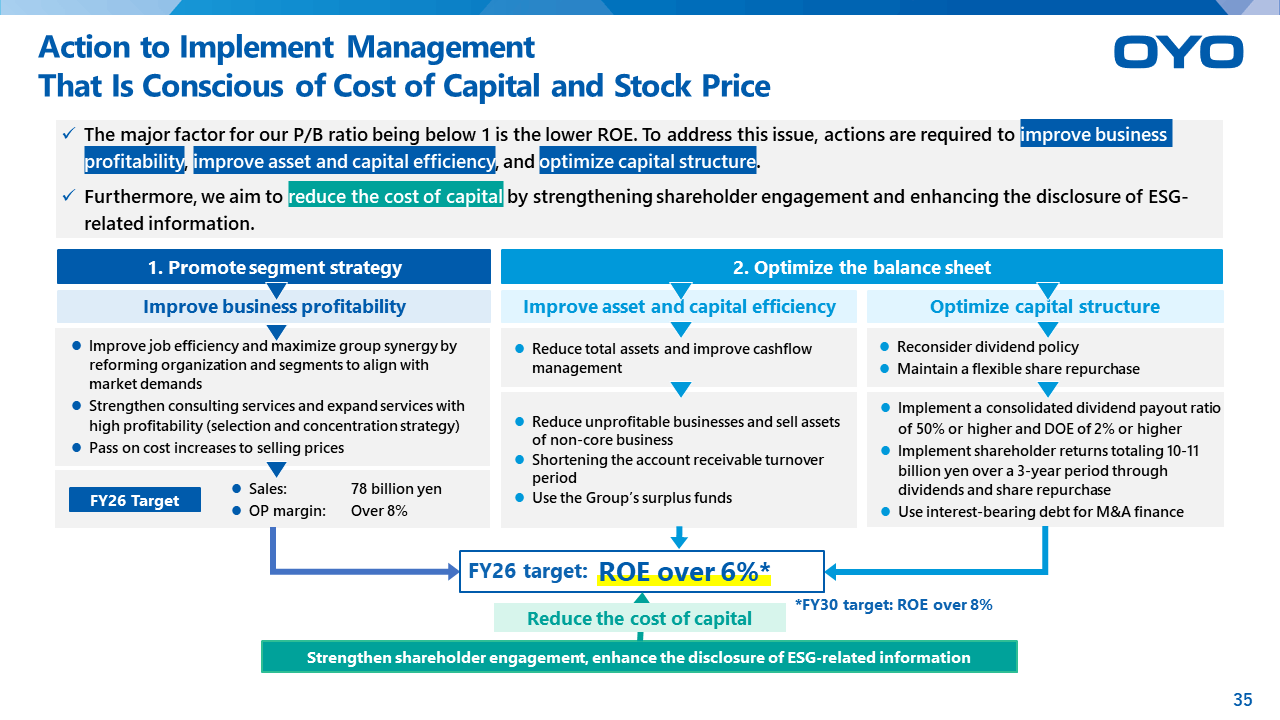

Action to Implement Management That Is Conscious of Cost of Capital and Stock Price

We will strive to improve PBR by pursuing "improvement of business profitability," "improvement of asset/capital efficiency," and "optimization of capital structure" with the goal of achieving ROE 6% or higher.

In addition, we will strengthen shareholder engagement and reduce capital costs by expanding ESG disclosures.